Dear Readers,

Before I get into the main topic today, I am excited to let you know I will be speaking about AI in veterinary medicine at several conferences this fall. The first event will be in a few weeks at the Veterinary Innovation Summit in Kansas City, where I will be presenting a short talk and then participating in an interactive panel discussion with Petra Harms, Joe Mazzarella, Jonathan Lustgarten, and Patrick Welch.

The second event will be a TED-style talk at the Hill’s Global Symposium in October titled “Augmentation, Not Replacement: The Use (and Misuse) of AI in Veterinary Medicine”. My presentations at both events will focus on computer vision AI (different in many ways than generative AI / large language models), how it’s being used in human and veterinary radiology and pathology, and a philosophical discussion about the ethical, medical, and legal considerations at hand. You can attend this event in person or via livestream. I will also try to send my readers a version of this content in a future newsletter, although I have to review the copyright and exclusivity provisions in my contracts.

—Eric

A(n overdue?) Market Correction

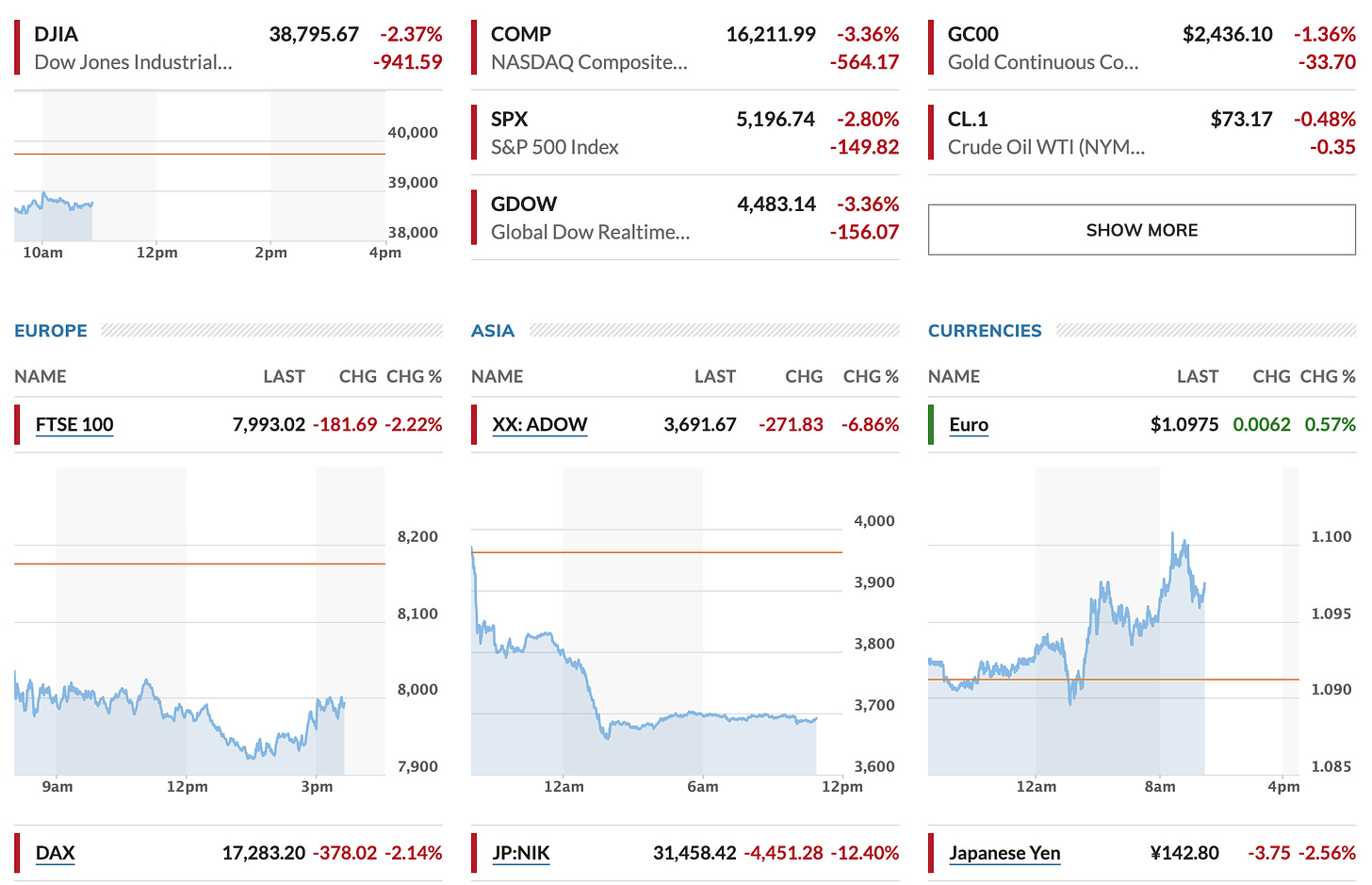

I have been working on this article for a few weeks, but today is coincidentally a perfect time to post it based on the widespread downturn in global stock markets:

The main explanation most people will provide for this market sell-off is US Fed policy and last week’s disappointing jobs report stoking fears of a recession. That is undoubtedly part of the story, although there is a lot more complexity beneath the surface—the biggest drop came from the Japanese Nikkei 225 at greater than -12%, and much of that is due to economic issues that are fairly specific to Japan.

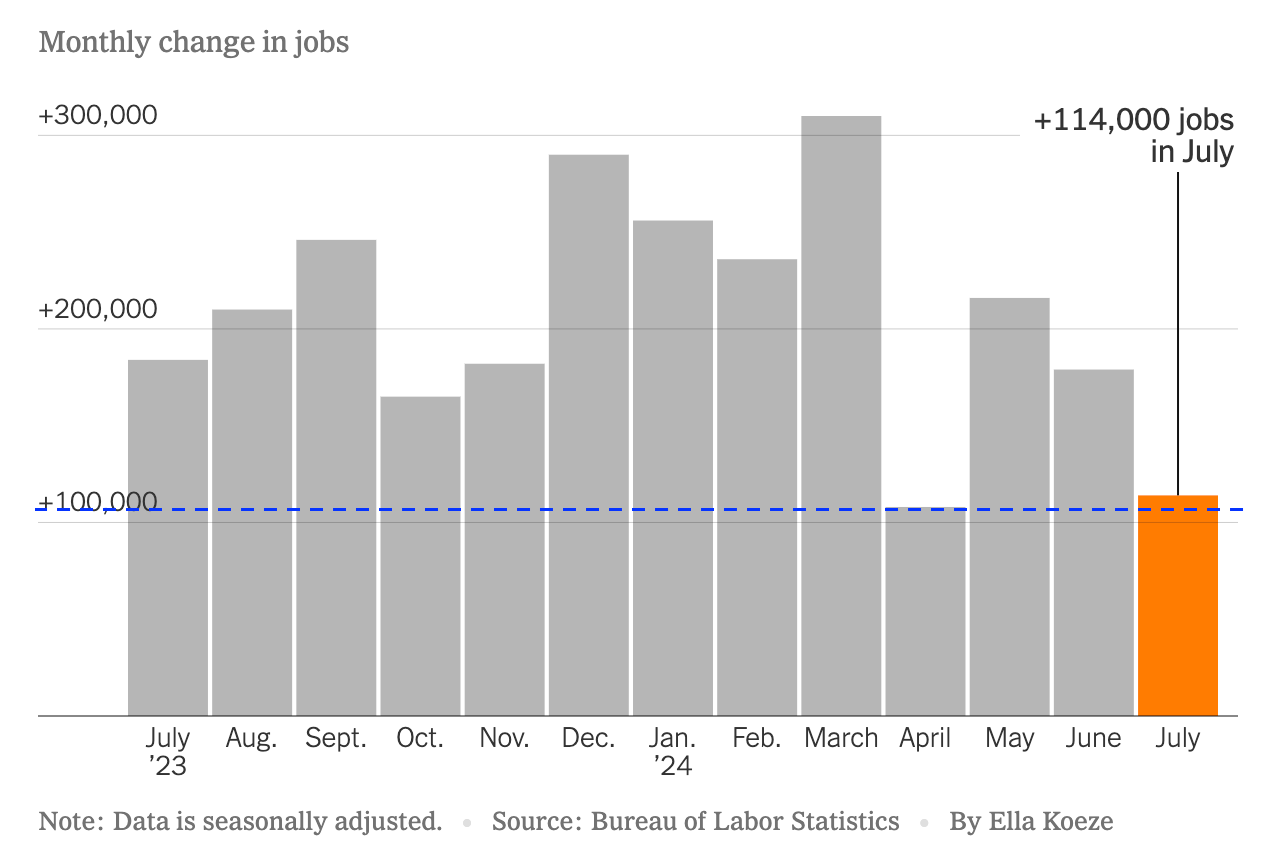

In my opinion, the market reaction today is disproportionate to last week’s job report that was…fine. The labor market data has been noisy and the July numbers were better than April when nobody freaked out. Cooling a hot economy should not be a surprise: that was the intended result of Fed interest rate hikes! We’ve also seen dramatic progress on reducing inflation over the past year. Despite those job numbers, overall unemployment remains quite low by historical standards (4.3%) and economic growth in the US more than doubled from Q1 (1.2%) to Q2 (2.8%).

Why should any of you care about this stock stuff? Underneath the big macroeconomic story, there have been simmering worries that the AI and GPU chip manufacturer companies that have been driving much of the market rally over the last 12-18 months were overvalued and poised for a correction. For one example, Microsoft saw a big drop in its value after their Q2 earnings statement reported weak growth in cloud revenue and AI capacity, and forecasted weaker earnings in Q3. In my opinion, a significant driver of the recent market negativity is investors who have been bearish on tech generally, and AI specifically, waiting for an excuse to sell.

AI Investment: The Trillion-Dollar Bet

A recent Goldman Sachs analyst report provides some support for this view based on a detailed examination of the investment costs, risks, adoption, and potential return on investment of generative AI. The report highlights a staggering fact: tech giants are set to spend over $1 trillion on AI-related capital expenditures in the coming years. Much of this spending is part of the AI buildout phase, with large cloud computing companies like Amazon, Google, and Microsoft spending on data centers, GPU chips, other AI infrastructure, and even upgrades to the power grid. Point in case: In February, Sam Altman of Open AI was reportedly seeking $7 trillion (with a T) in investment for these purposes. Considering tech investors often seek 10x their money in return on investment (ROI), this does not seem terribly realistic (there was only $103 trillion in the whole world at the end of 2023 🤔).

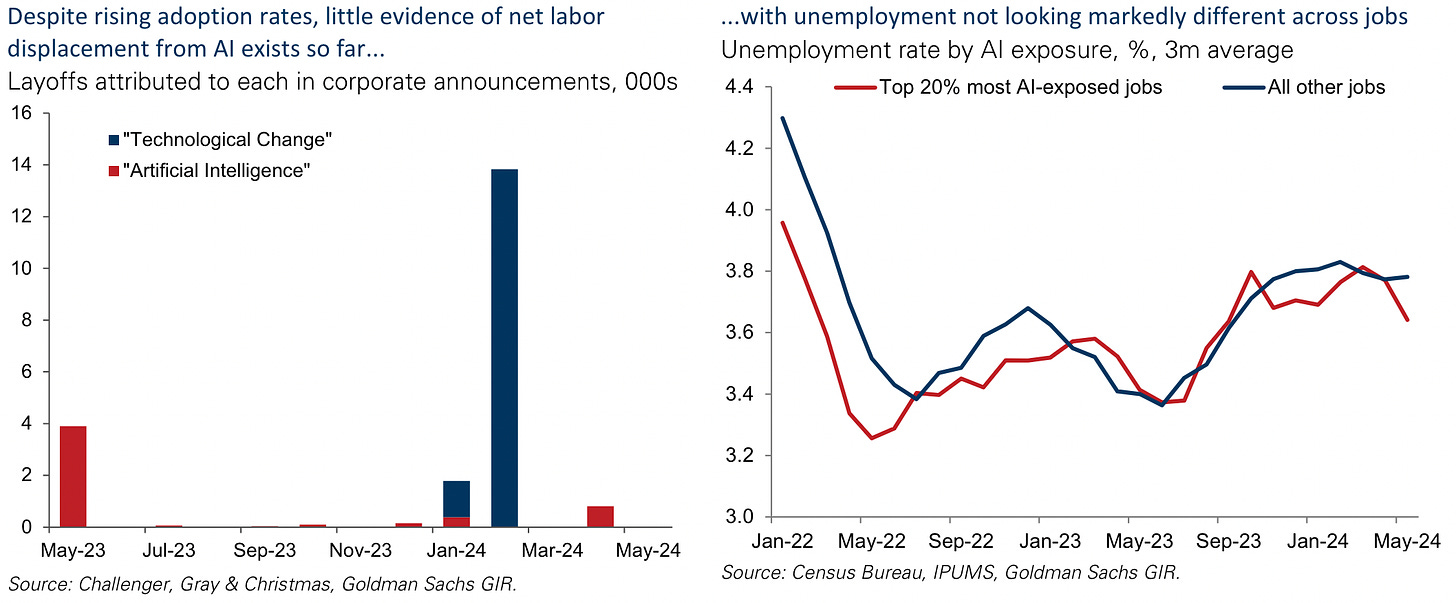

Despite the astronomical costs, tangible ROI has not substantially materialized, and these companies are hemorrhaging money; AI-only companies like OpenAI are deep in the red and far from profitability. Daron Acemoglu, an MIT professor quoted in the report, estimates that only a quarter of AI-exposed tasks will be cost-effective to automate within the next decade, suggesting AI will impact less than 5% of all tasks. He predicts a mere 0.5% increase in productivity and a 0.9% increase in GDP over the next ten years, far below the more optimistic forecasts.

Goldman Sachs’ own Jim Covello echoes this concern, arguing that the $1 trillion infrastructure buildout must solve extremely complex problems to earn a proper return on investment. He points out that historically transformative technologies, like the internet, offered low-cost solutions from the outset, unlike today’s expensive AI technology. I agree, and have been telling people for a while that AI may not replace many jobs in the medical sector because it will simply be cheaper to have humans do those tasks, and that is before factoring in concerns about accuracy and liability!

Moreover, the monopolistic position of companies like Nvidia in the GPU chip market raises concerns. While competition drove down costs in previous tech cycles, the current landscape lacks sufficient competition to guarantee similar cost declines. The high starting point for AI costs means even if costs do decrease, they need to do so dramatically to make widespread AI adoption economically viable.

NYU neuroscientist, machine learning researcher, and generative AI skeptic

has spent a lot of time over the past year pushing back on the LLM hype. He published this prescient piece last week:Measured Optimism About the Future

The Goldman Sachs report does present an optimistic case for AI adoption and disruption. Goldman’s Joseph Briggs estimates that AI could automate 25% of all work tasks, boosting US productivity by 9% and GDP growth by 6.1% cumulatively over the next ten years. His optimism is grounded in the expectation that technological advancements will drive down costs and increase the economic feasibility of AI automation. Plummeting costs over time happened with hardware-intensive tech like laptops and mobile phones, so it certainly could happen again.

This report also notes that generative AI development and implementation is still very much in the early days. Adoption of genAI by different industries remains modest, with less than 10% of US companies using it now or planning to within the next 6 months.

Generative AI has not yet found its “killer app,” although this can take a few years in the technology adoption lifecycle. If companies do discover novel use cases for generative AI that reap huge efficiency gains and the rate of adoption soars, the hype may become justified. For now, the AI investment boom represents a high-stakes bet on the future, and investors and companies must tread carefully. Whether it pays off will remain to be seen…

I totally agree that the AI bubble is just that. It has all the usual ingredients. Excellent summary of the market forces and underpinnings thank you. For me AI has been a bit of a productivity tool, and I selectively use it to craft some patient education, and every once in a blue moon i use it to brainstorm diagnoses and possible testing strategies with opaque problems. But I’ve spent 0 dollars on this as I’m sure 99% of the rest of the world has not either. I have a post in the Doximity queue (floundering there for 2 months!) about AI ambient progress notes… anyway, looking forward to following this with you!

Is AI another tech bubble?