The Unofficial Tech-Bro Dictionary

Dissecting the vocabulary and behaviors of start-up culture

“Tech-Bro”

You’ve heard the term thrown around, but what does it mean? Many people picture Steve Jobs, Mark Zuckerberg, or worse, Elon Musk. They are increasingly the villains and/or butt of jokes in shows and movies like HBO’s Silicon Valley and Rian Johnson’s Glass Onion. The phrase is vague—it has almost become a vibe or an aesthetic, with connotations of wealth, privilege, smarm, and sometimes clueless ineptitude. It is also increasingly associated with grifters who push half-baked or even fraudulent products.

I’ve spent a bit of time in start-up culture within veterinary medicine and have several friends there still. Some people may have even thought of me as a tech-bro at points (shudder)! There is definitely a unique lexicon and behavioral quirks that take some getting used to.

The Cambridge English dictionary defines a tech bro like this:

Urban Dictionary helpfully adds this descriptor: “People trying to reinvent the wheel with some dumb new technology.” When an unnecessary wifi-powered juicer start-up raises $120 million before shutting down, its hard to argue with that definition.

Without further ado, I submit my unauthorized dictionary for tech-bro culture!

Burn Rate

Most start-ups lose money. Like, a LOT. At least initially. This makes sense as new businesses have initial legal and licensing costs, capital equipment to buy, employees to pay, marketing costs and more before they are ever off the ground and running.

“Burn rate” is the term for how much money (from investors) a start-up spends every month/quarter/year. This drains the balance from fundraising rounds, referred to as “runway.” In theory, you start with family & friends or other seed money +/- angel investors, then go through a few progressively larger rounds such as Series A/B/C. The goal is supposed to be to grow and eventually become a sustainable business without needing more cash infusions.

Where this started to go sideways is the trend of unprofitable companies like Uber, Snapchat, and Spotify going through progressively larger and larger fundraising rounds without becoming sustainable on the logic that if they can take over the market, they will eventually be able to raise prices and make the math work out. Uber in particular went through an eye-popping THIRTY ONE fundraising rounds—a total of $24 billion—before going public and they are STILL not profitable!!!

This dynamic was hilariously skewered in this clip from HBO’s Silicon Valley:

The question of whether many of these companies even have viable business models certainly seems like it is no (if Uber couldn’t make a profit during covid-19 lockdowns when everyone had to use them, when will they?) A question that is still open is: how long will investors keep subsidizing these losers?

Churn

This is simply a term for lost customers. It can happen when someone deactivates their account or unsubscribes to your service or stops buying your product. Companies work hard to prevent this. Ideally, this would be by offering a killer product that nobody could do without. Oftentimes, though, they implement artificial guardrails to prevent people leaving. The New York Times used to do this by making it easy to sign up for an account, but to cancel required contacting them by phone. (They have since introduced an online cancellation option, but its not the easiest to find).

Threads, Meta’s Twitter copycat, recently made news for being the fastest app or web service to reach 100 million signups. But engagement is already declining, probably because the experience generally sucks:

However, Meta has one more trick up its sleeve: You can pause your Threads account, but deleting it (and all of your sweet, sweet data that advertisers covet) requires deleting your Instagram account, which will surely keep many people locked in.

Deck

It’s PowerPoint. Normal people call “decks” PowerPoint.

DiSrUpToR

“Disruptor” has become so cliche and overused it’s borderline cringe. It’s a staple of LinkedIn headlines and “broetry.” It’s also used incorrectly by most people who call themselves disruptors.

The term “disruptive innovation” originally comes from the best-selling business book “The Innovator’s Dilemma” by Clayton Christensen. The key idea, illustrated below, is that incumbent firms tend to continue producing new technology that optimizes for specific performance parameters the market seems to like, such as processing speed or RAM, and further enhancements become more and more expensive. Meanwhile, new technology comes along that is worse in some respects—i.e. laptop chips that are slower than a mainframe processor—but cheaper, and may have new benefits, like lighter weight or more portability. The companies specializing in this new, ahem, disruptive innovation, then take off and achieve great success displacing the older companies.

This falls apart with so many tech start-ups today. Using Uber or AirBNB was originally much cheaper than calling a taxi or booking a hotel, but (and this is critical) it was not for any technological reason, rather these companies simply subsidized the customer—at massive losses, see burn rate—to gain market share and crush legacy industries. Eventually, all were forced to raise prices to stop the financial bleeding, and today these tech-enabled services can often be more expensive than the original version. Another recent example of a disruptive start-up is Theranos challenging the medical testing industry, which to be fair, did come with the tradeoff of faulty medical test results that could harm patients.

Disruption is supposed to refer to the business model and technology, not just upending society for the personal gain of the founders and early investors.

Frictionless

In the parlance of tech start-ups, “friction” is anything that distracts or slows down a user or provides an opportunity to not follow-through on something (like a purchase). Websites and apps increasingly use little tricks like pre-filled fields, one-click ordering, and single sign-on to make it easier to use and spend time on their products.

This assumes that friction is always bad. I disagree. Sometimes what we need is a brief pause to reflect and consider decisions, not simply be nudged down the line to an action that benefits someone else.

In the world of diagnostic test ordering, adding extra fields and questions for medical information takes a little extra time for customers to fill out. C-suite types always push back on this. It adds FRICTION, and friction is BAD. I’ve explained so many times that more information upfront is better because it leads to more correct diagnoses and less cases that need re-work, but we are forever fighting an uphill battle triggered by the Jeff Bezos Amazon dictum: delight your customers, even if it results in worse quality overall.

Innovator

One who innovates. This is how almost all techies view themselves, even if what they are creating is the 1,876,985th version of an app, dating site or social network that already exists. Disgraced ex-WeWork founder Adam Neumann’s start-up Flow is trying to make renting apartments seem like a sexy new innovation.

IPO

Stands for Initial Public Offering, when a private company becomes publicly traded on the stock market. Start-up founders get rich in one of two ways, and it’s not a lifetime of working at the same company and earning a portion of the proceeds. They generally receive a windfall when their company is acquired by a bigger form or during an IPO. The public disclosures required for going public have doomed some companies; WeWork notoriously crumbled after their SEC disclosures revealed terrible financials and poor leadership.

Pivot

When you change your fundamental product, service, target market, or strategy. Flexibility is a great thing in business and life, and especially important for early stage companies with limited money. However, many start-ups “pivot” chaotically by jumping from idea to idea without focus or coherence because they haven’t found “product-market fit,” ie. a thing people want to give you money for.

🚀🚀🚀 Rocketship 🚀🚀🚀

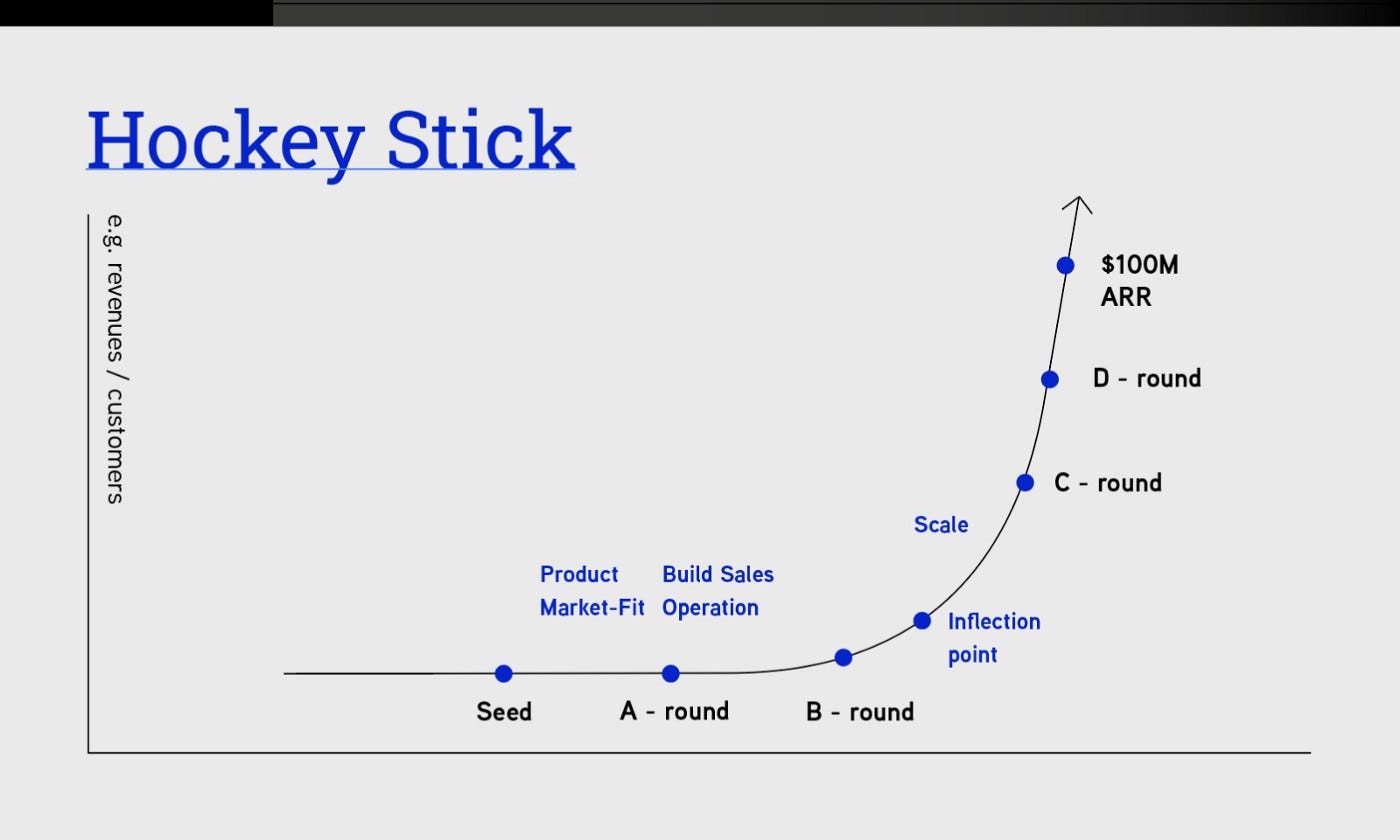

Often referred to simply by the emoji, the concept of the rocketship is a meteoric rise in customers and sales. Frequently tech bros will use it as an optimistic expression of future success and riches. It can be invoked after a big sale or positive pitch, or to ward off any negativity from bad news. Founder pitch “decks” often use a version of the concept through the infamous “hockey stick graph”

“This experience has left me confident to say there are two slides that are all I need to see in order to help me make my decision. In my eyes, these can absolutely make or break your chances at scoring funding. Two slides that are so essential, I’d wager that if you don’t have them, there is a high chance you won’t receive an investment. I like to call these slides: 1) The Hockey Stick Slide and 2) The 2X2 slide.”

As you can imagine, these pitches are occurring in the first few bullet points and the exponential future is a very hypothetical extrapolation of numbers that often have no basis in reality. There is heavy temptation to use fuzzy math in slides like this because it determines whether you get funding or not, and as I said at the start, new businesses burn cash.

SaaS

Pronounced “sass,” this acronym stands for “Software as a Service.” Traditionally, software was sold as individual units for one time purchase. Think CD-ROMs with Windows or Adobe Photoshop or just about any video game. Sometime in the early to mid 2000s, businesses realized that using internet distribution channels to download new content and updates could justify additional payments, and suddenly those one time purchases could be converted into the Holy Grail of business: predictable recurring revenue through a subscription.

This led to an explosion of iPhone apps and normal software that costs $5-10 or $20+ a month to keep using. We’re now living in a world where something as basic as Microsoft Word or Excel (sorry, “Office 365” and now “Microsoft 365”) requires a monthly or annual subscription to use.

This has now inspired countless XaaS (zass??) acronym clones to rebrand old products as innovative new business models, everything from DaaS (“data as a service”) to PaaS (“pathology as a service” 🙄).

Superpowers!

The first time I heard an entrepreneur ask me what my “superpower” was I thought they might be having a psychotic break. When this happened a few more times I did some searching online and quickly found that founders reframing basic life skills like “storytelling” and being “results-driven” as if they were superhero powers is a THING. It definitely fits with the narrative that tech founders are mythical heroes fighting the forces of evil (boring old legacy corporations listed on the S&P 500).

TAM

This acronym stands for “Total Addressable Market.” Being able to estimate the market potential of a new product or service is critical to attract investment and make wise use of limited resources (especially for early-stage businesses). But too much of a laser-focus on TAM can lead to bad strategic decisions. A great example can be seen in the veterinary point of care digital cytology market.

Many labs have rushed to put scanners into the broad swaths of general practice clinics, rather than surgically targeting emergency and specialty clinics. At first glance, this makes sense to the MBA types, because there are tens of thousands of general practice hospitals in North America, while the number of specialized clinics is measured in the hundreds to a few thousand. If you do some general back of the envelope math, it looks like a no brainer to focus on the much bigger TAM of the GP market.

However, if you know that cytology volumes essentially follow a power law distribution, with a low number of very high-volume clinics driving most caseload, you know that this approach is the most logical, while putting a ton of expensive scanning hardware into clinics that will barely use it will result in a ton of wasted money and disappointment.

Unicorn

A start-up that is “worth” over one billion dollars. These used to be as rare as, well, unicorns. However, they exploded in number in the 2010s, fueled by low-interest rates, which creates both cheap debt and a desire to seek higher yield than a sluggish stock market or anemic returns on CDs and money market funds.

The key phrase here is “worth.” This is based on their valuation, which is in turn based on the amount of investment and how much stake in the company those investors received for the money. Since valuations can be highly speculative—many of these companies had little to no revenue and high burn rate—it is not uncommon to see a hot unicorn implode from being worth billions on paper to $0 overnight, which generally doesn’t happen to more established companies. See: WeWork.

VCs

Nominally standing for venture capital(ist), this could easily stand for Visionary Casino because VCs throw money around like the craps table in Vegas, and what they are looking for is founders with the most confident and messianic VISION. Think this is just my sarcastic hyperbole? SoftBank, one of the most risk-loving VCs who funded WeWork, Uber, and many other money incinerators based on liking the cut of the founder’s jib, literally calls its flagship investment vehicle the Vision Fund.

VCs fund high-risk start-up businesses on the principle that many will fail, but a few outsize winners will more than pay off (see also: gambling). Even so, there should be some degree of due diligence and rational assessment of risk. But during the frothy second tech boom of the 2010s through 2021, VC firms—fueled by nearly-free money with interest rates near zero—began spending like drunken sailors on any random idea, no matter how implausible or foolhardy. A wifi-powered juicer? Sure! Real estate as tech venture? Awesome! A crypto scam like FTX? Sequoia is all in!!

VCs over the past several years have demonstrated not just poor judgment in the types of start-ups they fund, but who they fund. Surprise surprise, it is overwhelmingly white wealthy men, at the expense of women founders and people of color:

“Of all VC funding over the past decade, Latinx women-led startups have raised only 0.32 percent while black women have raised only .0006 percent. And while 2017 saw the highest amount of funding raised by companies founded by women of color, they still remain shockingly underfunded compared to others, both in the number that get investments and the amount of funds they receive. The question then is why—if everyone knows such disparities are happening—are funders allowing them to continue?

One reason may be that many VCs simply don’t recognize the problem. Last year, a Morgan Stanley-funded survey of 101 investors found that nearly 60 percent believe women and minority-owned businesses receive “about the right amount of capital” while 20 percent believe they receive “more capital than they deserve.” The study attributed this false perception to the fact that many white and male investors don’t often have many women or people of color in their professional networks, and so do not review many minority and women-founded businesses. Further, they don’t make doing so a priority. Then, once women and non-white business owners do get a foot in the door, they have to go the extra mile to prove their redeeming qualities, and overcome higher perceptions of risk, than their white, male counterparts.”

This myopia and groupthink almost certainly contributes to the blindspots that lead to business failures and stifle innovation.

If this was just rich people losing other rich people’s money, that would not be the biggest problem in the world. But investment capital IS critical to drive entrepreneurship and innovation, and it is a limited resource. Spending it on foolish ideas and/or business ventures that merely extract money from the masses without tackling the big issues facing society is a huge lost opportunity.

We need next-generation technology for better drug development, to fight climate change, and to harness AI and robotics for smarter city design. What we DON’T need is one more SaaS app that loses money even after they IPO.

I hope you enjoyed this sarcastic take on start-up vocabulary! Clearly, not everyone in start-ups fits these stereotypes, and tech entrepreneurs have indeed changed industries and contributed a lot of good to the world. I do think some of them have done a lot of damage, and we should be armed with a decoder ring to catch scammers and learn from their mistakes. Hopefully, my friends who are still in the start-up world can have a sense of humor and poke fun at themselves. I know I can!

It’s PowerPoint. Normal people call “decks” PowerPoint

Thank you for this 🎉

Eric, this is amazing! You hit so many topics spot on, while keeping it light and funny. I would love to see this turned into a skit or a graphic novel 🤘🏽🚀🚀